Get This Report on Real Estate Reno Nv

The Definitive Guide to Real Estate Reno Nv

Table of ContentsThe 6-Minute Rule for Real Estate Reno NvSome Known Details About Real Estate Reno Nv The 6-Minute Rule for Real Estate Reno NvThe 8-Minute Rule for Real Estate Reno Nv

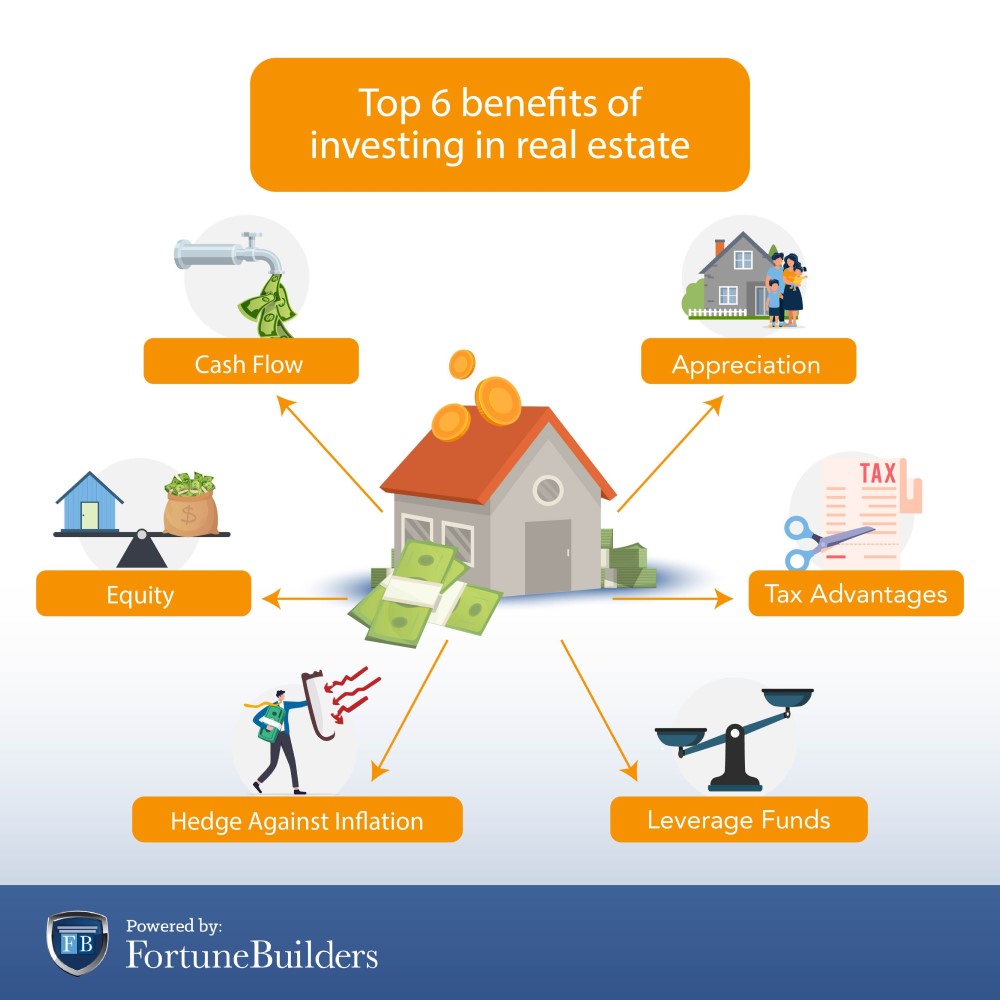

That might show up costly in a globe where ETFs and common funds might bill as low as zero percent for building a diversified profile of supplies or bonds. While platforms may vet their financial investments, you'll need to do the exact same, and that suggests you'll require the skills to analyze the possibility.Like all investments, genuine estate has its pros and cons. Long-lasting admiration while you live in the home Possible bush versus rising cost of living Leveraged returns on your investment Passive income from rents or with REITs Tax advantages, including rate of interest deductions, tax-free funding gains and devaluation write-offs Taken care of lasting funding readily available Admiration is not assured, specifically in financially clinically depressed locations Residential property costs might fall with higher rate of interest rates A leveraged investment means your down payment is at risk Might call for significant time and cash to manage your own residential properties Owe an established home loan repayment every month, even if your tenant does not pay you Reduced liquidity for genuine home, and high compensations While real estate does supply several benefits, especially tax benefits, it doesn't come without significant downsides, in certain, high compensations to exit the market.

Do you have the sources to pay a home mortgage if an occupant can't? Just how much do you depend on your day job to maintain the investment going? Willingness Do you have the need to function as a landlord? Are you happy to deal with renters and recognize the rental legislations in your area? Or would certainly you like to analyze offers or investments such as REITs or those on an online system? Do you desire to meet the demands of running a house-flipping business? Expertise and skills While several financiers can find out at work, do you have special skills that make you better-suited to one kind of investment than an additional? Can you evaluate supplies and construct an eye-catching portfolio? Can you fix your rental building or repair a fin and save a package on paying professionals? The tax advantages on property differ widely, relying on how you invest, yet purchasing genuine estate can offer some large tax obligation advantages. Real Estate Reno NV.

Top Guidelines Of Real Estate Reno Nv

REITs offer an appealing tax obligation account you will not sustain any type of funding gets tax obligations till you market shares, and you can hold shares literally for decades to avoid the tax man. In truth, you can pass the shares on your beneficiaries and they will not owe any kind of taxes on your gains.

Realty can be an appealing financial investment, yet capitalists wish to make sure to match their kind of financial investment with more helpful hints their readiness and capacity to handle it, consisting of time dedications. If you're aiming to create revenue throughout retired life, realty investing can be one method to do that.

There are several advantages to spending in genuine estate. Constant earnings flow, strong returns, tax benefits, diversity with well-chosen assets, and the capacity to take advantage of riches through actual estate are all advantages that investors might delight in. Here, we look into the numerous benefits of buying realty in India.

The 3-Minute Rule for Real Estate Reno Nv

Genuine estate tends to appreciate in worth over time, so if you make a wise investment, you can benefit when it comes time to market. Over time, leas additionally have a tendency to raise, which might enhance capital. Leas raise when economic climates increase because there is more need for actual estate, which raises funding worths.

Among the most appealing resources of easy revenue is rental revenue. One of the simplest approaches to maintain a consistent revenue after retired life i loved this is to do this. If you are still functioning, you may maximise your rental income by investing it following your monetary goals. There are various tax obligation advantages to realty investing.

It will dramatically lower taxed income while lowering the price of genuine estate investing. Tax reductions are supplied for a variety of prices, such as business expenses, cash money flow from other properties, and home loan interest.

Actual estate's link to the various other primary asset teams is delicate, at times also adverse. Discover More Here Realty may consequently minimize volatility and increase return on threat when it is included in a profile of various assets. Compared to other assets like the stock market, gold, cryptocurrencies, and banks, investing in realty can be substantially much safer.

Real Estate Reno Nv - Questions

The securities market is continuously altering. The property industry has expanded over the previous several years as a result of the execution of RERA, decreased home mortgage rates of interest, and various other variables. Real Estate Reno NV. The rates of interest on bank interest-bearing accounts, on the various other hand, are reduced, especially when compared to the increasing inflation